[NEWS FOCUS] War on duty free licenses ends, only for now

Calls grow to revamp license bidding process, lower license fees as duty-free operators’ profits bleed

By 원호정Published : Dec. 19, 2016 - 16:34

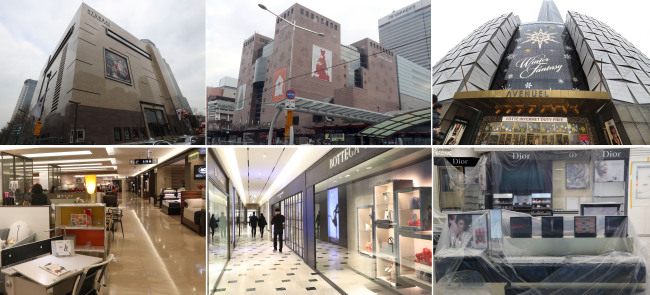

Saturday’s announcement of six new duty-free licenses in South Korea brought a sense of closure to heated competition, yet simultaneously amplified ongoing debates on the efficacy of the current licensing process on duty-free operations.

The Korea Customs Service gave three highly-coveted duty-free licenses to conglomerates in Seoul, bringing the total number of duty free shops in the capital to 13.

The golden tickets went to Shinsegae DF, Hyundai Department Store and Lotte Duty Free, after a long and exhaustive fight filled with flashy plans for drawing in tourists and massive pledges to invest in the surrounding community. However, the race was not without controversy -- there were allegations that some companies attempted to pull strings to win back the license.

The Korea Customs Service gave three highly-coveted duty-free licenses to conglomerates in Seoul, bringing the total number of duty free shops in the capital to 13.

The golden tickets went to Shinsegae DF, Hyundai Department Store and Lotte Duty Free, after a long and exhaustive fight filled with flashy plans for drawing in tourists and massive pledges to invest in the surrounding community. However, the race was not without controversy -- there were allegations that some companies attempted to pull strings to win back the license.

Now, calls are intensifying for the government to change the way in which it regulates duty-free operators, moving away from a competitive bidding process towards a registration system that would allow any company to run duty-free operations with strict qualifications.

“There’s no reason to make companies compete with each other for licenses, when the market will naturally weed out those who are uncompetitive,” said a spokesperson for one of the duty-free operators. “Even among the companies that have won licenses based on their competitiveness, you see huge differences in sales. Natural competition would keep the number of operators low on its own.”

An employee of another duty-free corporation said, “The bidding process is not only exhausting, but a huge drain on resources.

“Companies make huge investments to renovate their locations to increase their competitiveness, not to mention the big pledges for community investment that are hard to take back even if they lose the bid.”

The KCS has taken the official stance that removing the bidding process would flood the market with operators, complicating regulations concerning product quality and skewing the market towards large conglomerates with hefty marketing budgets.

In 2013, the National Assembly passed an amendment to the Customs Act that shortened licensing periods to five years from ten years, and stopped automatic license renewals.

This year, the National Assembly tried to walk back the change and re-extend licenses to ten years to reduce confusion in the market, but the motion failed to pass.

Requiring companies to renew their licenses every five years requires resource investments into the bidding process and also makes it difficult to make long-term development plans, industry insiders say.

The duty-free industry is harsh, even without the strenuous bidding process. All of the newly licensed duty-free stores that opened this year remain in the red, to the tune of tens of billions of won. Major duty-free operators compete with each other to sign big deals to bring in large groups of tourists, especially from China.

The Chinese travel agencies take a cut of the money spent by their customers at the duty-free stores, from 10 to 30 percent of sales. According to data from the KCS, these acquisition fees totaled 479 billion won ($403.4 million) in the first half of 2016, approximately 8.3 percent of sales revenue.

Duty-free stores also spend massive budgets on acquiring in-demand spokesmodels that appeal to Chinese tourists who are interested in Korean pop culture.

Top-class actors such as Song Joong-ki and Jun Ji-hyun are brought in with millions of dollars on their contracts, yet it is difficult to see these investments translating directly into additional shoppers. According to the Korea Tourism Organization, 680,918 Chinese tourists came to Korea in October, just slightly up from 650,174 tourists last year.

Adding to the woes faced by the local duty-free sector, the Ministry of Strategy and Finance has announced that it will be raising fees next year on duty-free operators for their licenses. Depending on each operator‘s revenues, the fees could rise by as much as twentyfold.

According to estimates from the Korea Duty Free Association, the increase would bring in 55.3 billion won for the government in license fees alone, up from 4.4 billion won in 2016.

The KDFA has officially protested the proposed increase, calling it a “unilateral” decision by the Finance Ministry with “serious problems in the administrative process.” The association has even threatened to file a lawsuit to block the amendment from taking effect.

By Won Ho-jung (hjwon@heraldcorp.com)

![[Robert J. Fouser] Social attitudes toward language proficiency](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050799_0.jpg&u=)

![[Graphic News] How much do Korean adults read?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050803_0.gif&u=)

![[Herald Interview] Byun Yo-han's 'unlikable' character is result of calculated acting](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/05/16/20240516050855_0.jpg&u=)