Hyundai Motor heir in NY in last ditch effort to win votes

By Cho Chung-unPublished : May 18, 2018 - 16:14

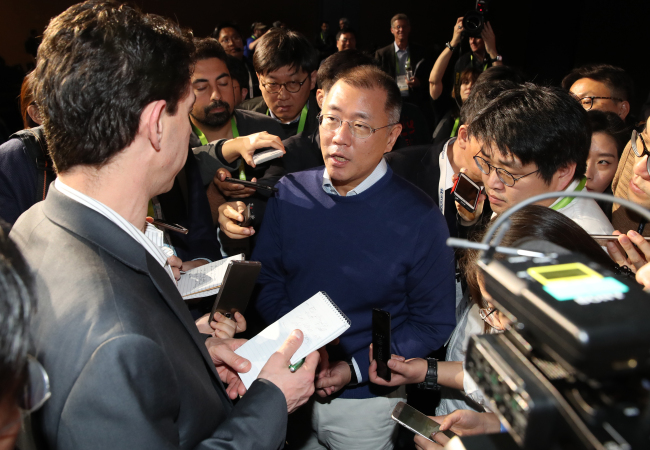

The crown prince of Hyundai Motor Group, the nation’s second-largest conglomerate, is in New York in an apparent move to convince foreign shareholders over the group’s corporate governance reform seeking a change of the hostile atmosphere against the plan.

Hyundai Motor officials in Seoul confirmed on Friday that Vice Chairman Chung Eui-sun has left for a business trip to US.

He was briefed over progresses made at Hyundai Cradle in Silicon Valley, a multinational startup incubator, the company said. He then visited the carmaker’s plant in Alabama and then New York, according to reports. The company declined to say whom he was meeting with and what mission he carried there. But it was widely seen as the heir making a last ditch effort to win votes from shareholders.

Hyundai Motor officials in Seoul confirmed on Friday that Vice Chairman Chung Eui-sun has left for a business trip to US.

He was briefed over progresses made at Hyundai Cradle in Silicon Valley, a multinational startup incubator, the company said. He then visited the carmaker’s plant in Alabama and then New York, according to reports. The company declined to say whom he was meeting with and what mission he carried there. But it was widely seen as the heir making a last ditch effort to win votes from shareholders.

Chung’s trip to the US came after five proxy advisers expressing negativity toward Hyundai’s plan, making the ongoing confrontation favorable to US hedge fund Elliott. Chung appears to have explained the goals of the plan that is aimed at securing a new growth engine for the carmaker’s future.

The group has proposed to spin off two units from Hyundai Mobis, an auto parts making affiliate, and merge them with Hyundai Glovis, a logistics arm.

The plan, subject for a vote on May 29, however, has met a growing stumbling block so far with local and global advisors to investors opposing.

Things got worse for the world’s fifth-largest carmaker on Friday with an adviser to the National Pension Service, the second-largest shareholder in Hyundai Mobis objecting the plan.

The Korea Corporate Governance Service advised NPS to vote against the plan. The local adviser’s conclusion came after an intensive discussion, insiders said, adding that the consequence of the merger deal remains uncertain.

The fate of Hyundai’s reform plan became uncertain, further dragging the value of related affiliates down on Friday.

Share price of Hyundai Mobis fell 3 percent in the morning trade while Glovis was down 1.64 percent at closing price.

Amid growing opposition toward the plan, market watchers say that Hyundai might ditch the merger deal and seek a plan B. Some say that Hyundai might consider revising the merger ratio, while keeping the merger deal. Institutional Shareholder Services, a proxy advisory firm, has voiced concerns on the swap ratio of 1:0.61 that it seems to be unfavorable for Hyundai Mobis shareholders, while saying that the condition for transaction are in compliance with Korean laws.

“Even if the plan got disapproved at shareholders’ meeting, we expect Hyundai to pursue another plan to restructure its corporate governance,” an analyst at KB Securities and Investment said in a report.

“Even without the pressure from the government, Hyundai Motor Group will come up with the new plan voluntarily to proceed with the transfer of leadership,” he said, adding that it is “rational” to complete the plan within this year, considering the recovery of overseas sales and a shift in popular models including Sonata in 2019.

The combined sales of Hyundai Motor and its sister brand Kia is expected to surpass the one million mark in Europe for the first time, the company said. In the January-April period, the two sold a total of 364,945 units in Europe, up 7.1 percent from a year earlier. In 2017, they sold a combined 995,383 autos.

By Cho Chung-un (christory@heraldcorp.com)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)