Hyundai, LG chiefs visit Indonesia to bolster EV, battery partnerships

Korean conglomerates eye growth in burgeoning market for EVs, batteries

By Byun Hye-jinPublished : Sept. 7, 2023 - 16:19

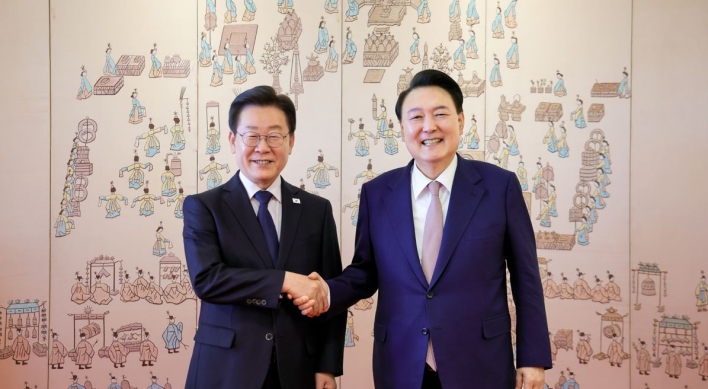

Following President Yoon Suk Yeol’s visit to Indonesia for the South Korea-Association of Southeast Asian Nations summit, South Korean conglomerates’ chiefs embarked on a business trip to the emerging country to boost cooperation on electric vehicles and construction projects, industry sources said Thursday.

Business leaders including Hyundai Motor Group Executive Chair Chung Euisun, LG Group Chairman Koo Kwang-mo, Lotte Group Chairman Shin Dong-bin and LS Chairman Koo Ja-eun were scheduled to participate in a business roundtable on the same day.

Korean companies were set to sign memoranda of understanding or announce setting up joint ventures with some 20 Indonesian firms during the event, according to sources.

Chung was expected to address ways of bolstering ties on the EV industry, according to the carmaker, although it did not share specific content of Chung’s speech that was made in the discussion session.

Hyundai Motor Group has been ramping up its electric car business in Indonesia, where it operates a car manufacturing plant in the city of Bekasi. It sold a total of 3,913 EVs and posted a 56.5 percent market share there as of July, with the flagship battery-powered sport utility vehicle Ioniq 5 taking up most of the sales with 3,819 units.

Adjacent to the plant, construction projects of a joint battery cell plant with LG Energy Solution and a battery pack production plant with Hyundai Mobis, a car parts manufacturer under Hyundai, are underway. Both facilities are slated for commercial operation next year.

Indonesia has been a strategic hub for the world’s third-largest carmaker, who is seeking to expand its footing in the Southeast Asian region against Japanese firms who currently dominate. Even during his term as senior vice chairman at Hyundai, Chung has made frequent visits to Indonesia, according to sources. After being named as the executive chair in October 2020, Chung visited Indonesia three times, during which he had meetings with Indonesian President Joko Widodo.

In line with Hyundai’s business expansion to Southeast Asia, its smaller affiliate Kia is reportedly looking to set up a car manufacturing plant in Thailand. Denying any concrete business plans on the matter, the carmaker said it is pursuing various channels to foray into global markets.

LG Group also holds high stakes in the emerging market. It first started business in Indonesia in 1990 when LG Electronics built a plant that produces televisions, refrigerators and air conditioners. Since then, other subsidiaries -- LG Innotek, LG CNS, LG Energy Solution and LG Chem – entered the market. LG is currently operating a total of four manufacturing plants and eight foreign subsidiaries.

The IT solutions unit LG CNS, in particular, clinched a deal last year with the Nusantara National Capital Authority -- a ministerial-level authority that oversees Indonesia’s new capital relocation project -- to design a smart city concept.

Industry insiders say Koo’s visit is likely to have highlighted the necessity of creating an EV battery supply chain in the country to mine and process key raw materials and produce battery cells.

“It is crucial to join forces with Indonesia, a country with abundant raw materials (for batteries) like tin, manganese, bauxite and cobalt as well as nickel,” said Shin Yoon-seong, a researcher at the Korea Institute for Industrial Economics & Trade, in a report issued by the Korea Chamber of Commerce and Industry. “(Korea) has a complementary business relationship with Indonesia.”

Lotte Group, who operates 50 Lotte Mart branches within the country, after entering the market for the first time for Korean distributors, opened a shopping mall complex in Jakarta in 2013. Lotte began expanding its footing in Indonesia after its petrochemicals unit Lotte Chemical landed a $3.9 billion deal to build a massive petrochemical complex in Banten province.

LS Group is eyeing Indonesia as its second Southeast Asian market, after topping the list of sales in low-voltage equipment in Vietnam. Last year, it completed construction of an electrical cable manufacturing plant in partnership with the local AG Group.

Experts say Indonesia is a country that can help reduce Korea’s dependence on China in EV and battery supply chains.

“Especially when the US and Europe are effectively shunning China in the global electric car market, it is strategically important to create a win-win synergy with Southeast Asian countries like Indonesia with abundant minerals and raw materials reserves,” said Kim Da-jong, a business professor at Sejong University.

Meanwhile, Hyundai Motor Group and Lotte Group have carried out promotional events to support Busan's 2030 World Expo bid in Jakarta, where the ASEAN summit was held.

![[KH Explains] No more 'Michael' at Kakao Games](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/28/20240428050183_0.jpg&u=20240428180321)

![[Grace Kao] Hybe vs. Ador: Inspiration, imitation and plagiarism](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/28/20240428050220_0.jpg&u=)