Most Popular

K-Food

[K-Food] HiteJinro at forefront of raising soju's global profile

More than 90% of global consumers recognize soju now, says Korea’s No. 1 soju exporter

By Lee Yoon-seoPublished : March 23, 2023 - 16:14

This is the fourth installment of a series of interviews with global business chiefs of South Korean food companies that are expanding aggressively in overseas markets. -- Ed.

Soju, South Korea’s national drink, has expanded its presence in global markets as the rice-based alcoholic beverage grows in popularity among spirit aficionados around the world.

According to market research firm 360 Research Reports, the global soju market is estimated to reach $4.2 billion in sales by 2027. As of 2021, the market value was $3.1 billion.

Amid the burgeoning market for soju, accurate analysis of each country's alcohol market -- centered on their market size and local competition, along with ramping up local customers' purchases of soju -- is essential to further secure the product's footing as a globally enjoyed beverage, said HiteJinro's managing director of the overseas division, Hwang Jung-ho, to The Korea Herald in a recent interview. HiteJinro is the nation's dominant soju and beer seller with almost 100 years of history.

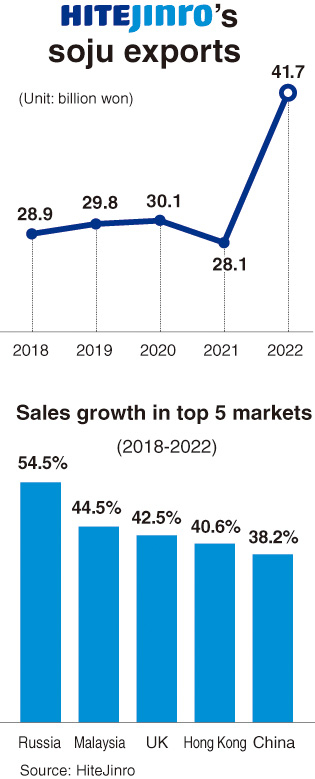

Last year, about 6 percent of HiteJinro’s sales, or 145 billion won ($112 million), came from abroad, with soju making up more than 80 percent of its overseas business. The company exported 116 billion won worth of soju last year, almost half the nation’s total soju exports.

The company's aggressive soju business abroad follows the heightened recognition and demands for the product, Hwang said.

“Based on our annual research, we have found some 90 percent of overseas consumers recognize soju now,” said Hwang, who also served as CEO of HiteJinro America from 2017-2019. “Many of the consumers say they consider soju a ‘trendy’ and ‘cool’ drink.”

HiteJinro's soju business strategy in the global market first centers around carefully analyzing market characteristics. The company has collaborated with global research firms such as Euromonitor and Globaldata to carry out a slew of research projects on awareness of soju around the world and people’s preference for different alcohol products.

Currently, China is one of the fastest-growing markets, with the company pouring resources there to secure a footing.

In China, where the alcohol market is crowded with strong liquor products with alcohol percentages above 50, HiteJinro targeted a niche for young people in their 20s and 30s who prefer weaker drinks with alcohol percentages below 20.

Because alcohol products are allowed to be sold online in China, unlike in Korea, the company also focused on expanding its sales through online retail channels such as Taobao.

After years of localization efforts, the company’s China sales almost tripled between 2019 and 2022.

Another key growth market for HiteJinro’s soju is Europe.

Spirits make up the smallest portion, or 8 percent, of alcohol sales there, while beer and wine account for 70 percent and 22 percent, respectively, according to the company’s own market research.

“But we found that products with low alcohol percentages are gradually gaining popularity– especially fruit-flavored spirits,” Hwang said. “Reflecting this consumer trend, we increased sales of fruit-flavored soju products through large supermarket chains across Europe.”

Over the past five years, the company’s European sales saw an annual growth rate of 35 percent. Last year alone, the growth figure was 48 percent year-on-year – one of the highest among the continents.

US sales have also seen robust growth after years of marketing activities targeting major retail chains such as Target and Costco. In the US, HiteJinro’s market share stands at more than 60 percent in terms of soju sales.

In the US, the company plans to ramp up promotional efforts using large-scale events such as music festivals and sports events, which have been proven as one of the most effective ways to raise soju awareness among local consumers. Currently, HiteJinro is a key sponsor of the Los Angeles Dodgers baseball team in the US and the All Point East music festival in England as well as the largest K-pop festival K-CON.